Bookkeeping basics: A guide for small businesses

The value of inventory can significantly impact a company’s financial statements, so accurate tracking and management is vital. When you start a new business, you need to set up a chart of accounts to journal transactions in any of the five categories including assets, liabilities, expenses, revenue and equity. This chart of accounts is used to gather statements, analyze progress, and locate transactions.

Boost your small business accounting knowledge

Recording and analyzing financial information can be difficult, and this is where accounting software comes in. Small business accounting software can help you accomplish crucial accounting tasks and ensure that you stay on top of your books throughout the year. While recording by hand may be the cheapest solution, it can be time-consuming and prone to errors.

Double-entry bookkeeping

Setting up a document management system can help with organizing your records so that they’re easier to review. There are different ways to organize files, depending on what you need to store. Customer Reviews, including Product Star Ratings help customers to learn more about the product and decide whether it is the right product for them. Whether you’re an accountant already or just looking to learn more about the field, I have something for you.

QuickBooks Support

Tracking and reviewing your income and expenses can help you assess the health of your business and plan for future growth. You can follow our guide on how to make an income statement to accurately evaluate your business’s financial health. Keep a separate bank account for your personal and your business expenses. If you’re a solopreneur or independent contractor, chances are you’re responsible for everything, including the accounting.

How do I choose the right bookkeeping software for my business?

Bookkeeping puts all the information in so that you can extract the necessary information to make decisions about hiring, marketing and growth. Another type of accounting method is the accrual-based accounting method. This method records both invoices and bills even if they haven’t been paid yet. This is a highly the purpose of a bank reconciliation recommended method because it tells the company’s financial status based on known incoming and outgoing funds. Because the funds are accounted for in the bookkeeping, you use the data to determine growth. Dawn Fotopulos provides a lifeline for small business owners who dread dealing with their company’s finances.

You can choose to record the transactions by hand, hire an accountant or choose an accounting software to automate your accounting process. Even if you aren’t planning on growing any time soon, you need to have a sense of how much money is coming in versus what is going out. On top of that, you need the data used in bookkeeping to file your taxes accurately.

It’s important to track your AR to ensure you receive payment from your customers on time. The accounting tips for small businesses can help you figure out long-term goals, ride financial ups and downs and increase your profits. Moreover, efficient bookkeeping strategies can help you stay out of trouble with the IRS. To simplify your bookkeeping responsibilities, create and stick to a schedule or accounting cycle.

This book covers the essential information small businesses need to know about taxes. As a result, you can ensure you stay compliant and legal to seamlessly prepare for taxes. The topics in this book have also been updated to match developments within the industry. This guide is a great way to break down complicated words and learn the language of accounting. Get a comprehensive understanding of your cash flow in 5 minutes or less.

All your data is in one place so you’ll always have access to the latest data even with multiple collaborators like your bookkeeper or your accountant. All of your bank and credit card transactions automatically sync to QuickBooks to help you seamlessly track income and expenses. A chart of accounts lists all business transaction and is used to compile statements, review progress and locate transactions.

While a bookkeeper is focussed on day-to-day transactions, the accountant concentrates on the strategic financial operations. If you’re planning to outsource your accounting activities, choose someone who is the best match for your business. Successfully managing your business also requires managing finances. When you’ve just started and have limited funds, you might consider handling your accounting activities yourself. However, once the business has sufficient discretionary funds, it’s best to outsource these tasks to an accountant or a bookkeeper.

Manually recording transactions by hand is the most time-consuming option for recording transactions. When you record transactions by hand, manually 3 3 process costing weighted average account for each transaction and calculate totals. Modified cash-basis, or hybrid accounting, is a mixture of accrual and cash-basis accounting.

- You’ll also need to present up-to-date financial statements to lenders if you plan to apply for small business financing at some point.

- When an invoice is past due, follow these five steps to collect outstanding payments so you can get paid sooner.

- Looking for an ultimate guide that you can reference time and time again?

- The book covers the basics of accounting, breaking down terms and calculations that are fundamental to the practice.

There are several types of business bank accounts, each with its own purpose and benefits. As a small business owner, you have the option of hiring an accountant, recording transactions by hand or using an accounting software to record your business transactions. The financial statements which include the income statement, statement of changes in equity, balance sheet, statement of cash flow and notes are the end products of the accounting system. As a business owner, it is important to understand your company’s financial health.

To avoid confusion during tax season, set up a separate bank account for your business. Develop a method of handling your data, actively managing your cash flow and reviewing your monthly and bank statement regularly. Organize your receipts (including receipts for charitable contributions) and accurately record deposits. By net financial position tracking your business expenses, you can increase profit margins and optimize your income tax return. Instead of calculating expenses every two weeks for payroll processing, you can keep records of the everyday business expenses. If you want your business accounting books to be accurate, keep them organized and up-to-date.

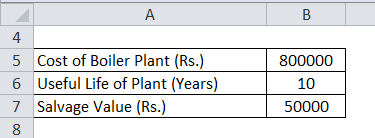

Meanwhile, the term liability describes a financial obligation to a person or organization outside the business that decreases value for the company. A typical small business liability is monetary debt, but this category also includes machinery depreciation, balances owed in accounts payable, and pending taxes to be paid. Understanding how assets and liabilities work is crucial for any business owner running a business.

Leave a Reply